- +1 (904) 508-0207

- 1646 Rogero Road Jacksonville, FL 32211

We Buy Houses in Jacksonville FL

Sell your property in Jacksonville FL. Get a no-obligation, hassle-free offer on your Jacksonville home. Pay no agent fees, no repairs, 100% FREE! Find out how our home buying process works!

We buy houses in Jacksonville FL, and surrounding areas, in any condition and in any situation and sells them fast for cash. Whether you are facing foreclosure, dealing with a difficult tenant, going through a divorce, or simply looking to sell your home for any other reason, we can help.

No commissions, no closing costs, no repairs, no agents, no fees.

Why Pay Agent Fees?

Why not request an offer from us? We are dedicated, and efficient, and guarantee that you won’t receive any disappointing ‘lowball’ offers. The best part is, everything comes 100% FREE, and there’s no obligation to accept. You have nothing to risk. Request an offer for your property today!

Selling a house can be stressful. It is not just the process of selling, dealing with real estate agents, walkthroughs, open houses, repairs, cleaning, and uncertainties, but also the reasons for selling, add to the already difficult process.

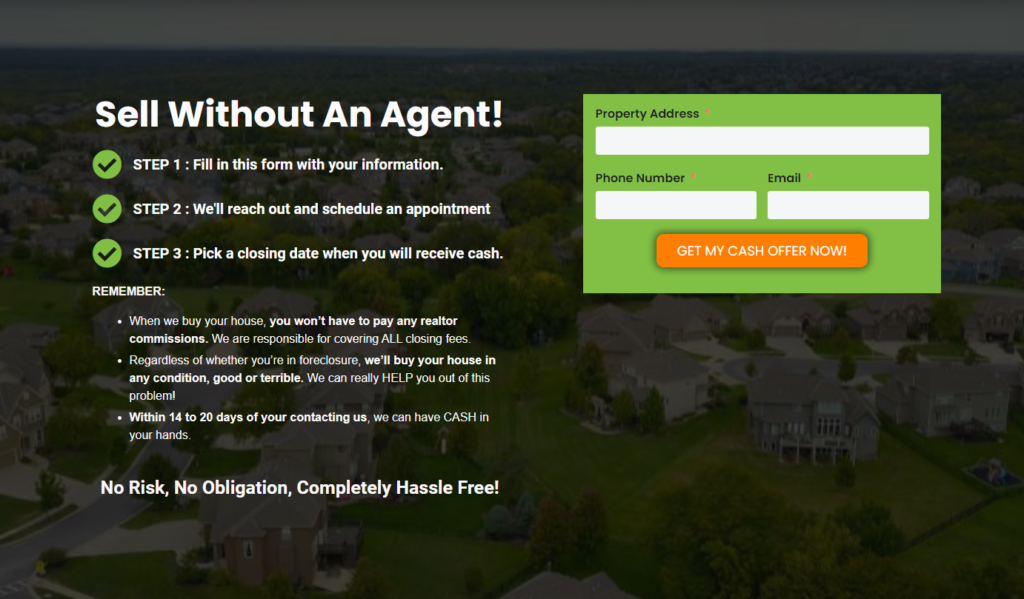

Selling your property in Jacksonville to us is super easy. We will handle everything so you don’t have to! Just fill in the form below to get your offer started. Remember, it’s 100% FREE and never any obligation to accept.

Get a No-Obligation Cash Offer Today!

"ALKO Home Buyers are the best without a doubt!! I managed to sell my house in Jacksonville very fast and ended happy with the deal. Mr.Konti is very professional and efficient. I recommend everyone to work with ALKO Home Buyers."

Caroline Depay

Homeowner

We Can Buy Your House in Any Condition, Any Situation!

Avoid paying agent commissions & closing costs, worrying about open homes, or expensive home restorations, we got you covered. We are home buyers in Jacksonville no matter what the situation or condition is for selling the property.

- Vacant House? Relocating?

- Damaged Due To Mold, Water, & Fire?

- Bad Tenants?

- Extensive Repairs Needed?

- Need To Avoid Foreclosure?

- Selling An Inherited Property?

How Do I Sell My House Fast In Jacksonville?

Selling your Jacksonville house for cash is fairly simple. We do this by cutting out the “middle man” (agents or banks). We can buy your home without waiting for approvals or inspections from outside parties. Remember, NEVER, EVER “low-ball” offers!

Visit The How It Works Page

Find out how we create your offer. We demonstrate a real bid we made on a house we paid cash for!

Learn About Our Company

We are sure that you won’t choose to work with just anyone. So learn a little bit about us!

Get Your All-Cash Offer!

We won’t waste your time. Receive your offer by completing one of our forms. We will tell you, selling your Jacksonville home is simple as 1..2..3!

No Realtors Fees, No Repairs, No Closing Costs

“I need to sell my house in Jacksonville fast but I do not want to pay agent fees or wait months hoping the house will sell. I just want to sell my house in Jacksonville and walk away with Cash in hand!”

We make it incredibly simple to sell your Jacksonville home quickly.

Sell your house, apartment, or condo to us so you won’t have to pay agency commissions or high closing expenses. Not even cleaning is necessary! That’s correct, no bother, no cleaning, no repairs, no realtor fees, no commissions from agents, and no extended waiting times!

We’ve got you covered!

Fast-forward to a closing date of your choosing instead of going through the complete listing procedure.

If you need to sell quickly, listing with an real estate agent is not always an option. It doesn’t matter if the property is vacant or occupied, in foreclosure, going through a divorce, getting tired of being a landlord, overdue on taxes, or even uninhabitable! No matter what, we can buy your house.

"Listing with an agent is not always an option if you need to sell quickly. It doesn't matter if the house is vacant or occupied, in foreclosure, going through a divorce, getting tired of being a landlord, overdue on taxes, or even uninhabitable! No matter what, we can buy your house."

Francine Carris

Homeowner

Cash for Your Jacksonville FL Fast for Cash!

Any Situation

We buy houses in Jacksonville, Florida, quickly no matter what situation you face – liens, code violations, taxes/mortgages.

Any Condition

No matter how big the repair is needed, it doesn’t matter. In fact, it will cost you nothing! Remember that the worse the condition of your house is, the more excited we get!

Sell Your House Fast For Cash in Jacksonville, FL

Offer Within 30 minutes!

You will get your offer right after the walk-through, and we’ll show how we calculate your offer. Total transparency.

Make No Repairs!

You will get your offer right after the walk-through, and we’ll show how we calculate your offer. Total transparency.

No Agent, No Realtor, No Commissions!

We do not involve agents or realtors in the buying process. This means no agent fees for you to pay!

Our Services Are FREE! We Pay Closing Costs!

Just fill-in the form, and we’ll present you with our offer. No obligation to accept.

No Need To Clean!

Take what you want, leave the rest. We’ll take care of it all. Feel free to decide whether you want to clean the house before selling or not.

Already got an offer? Let us try to beat it!

We really give the highest offers around. We are confident we can beat any offer, or at least we’ll try.

We Buy House As-is For CASH!

We buy houses as-is, ANY CONDITION! No matter how bad the condition and the situation of your property are we will make sure that you’ll get the best offer and leave with cash in your hands. Don’t worry about all the work, from dirty floors, toilets, damaged furniture, trashes, the food inside the fridge, and unused clothes because we got your back when you sell your home to “ALKO Home Buyers”!

If you are saying I wish I could sell my home fast in Jacksonville, call us to get a no-obligation, all-cash offer!

Are “We Buy Houses” companies legitimate?

Yes, we are typically investors who are looking to purchase properties quickly, often for cash. We are able to offer you a fair price for your home and close on the sale faster than if you were to sell through a traditional real estate agent.

We buy homes for cash in these cities...

A local cash home buyer in Jacksonville FL with a verified and impressive number of Google reviews. We buy homes in all these cities in Florida (Green Cove Springs, Mandarin, Orange Park, Riverside, Palatka, Callahan, Yulee, and Middleburg).

Whether you are trying to avoid foreclosure, inherited a property you do not want, are dealing with a divorce, or are fed up being a landlord dealing with tenants, we can help. If you need to sell your house in Florida fast, we buy homes for cash in Jacksonville!

Get your FREE cash offer today!

We buy houses in ANY CONDITION! We pay CASH and you will not pay any commissions, agents, or fees. Put your address and email below and answer 5 easy questions on the next page to get a cash offer in 24 hours!

We buy homes for cash in these cities...

ALKO Homebuyers is a Cash Home Buying team in Jacksonville FL with a verified and impressive number of Google reviews. We also buy homes in all these cities in Florida (Green Cove Springs, Mandarin, Orange Park, Riverside, Palatka, Callahan, Yulee, and Middleburg).

Whether you are trying to avoid foreclosure, inherited a property you do not want, are dealing with a divorce, or are fed up being a landlord dealing with tenants, we can help. If you need to sell your house in Florida fast, we buy homes for cash in Jacksonville!